Investigative Research and the Power of Data

Investigative recruiting research combined with data analytics holds the power to transform executive recruiting.The Executive Search Information Exchange advises Fortune 500 companies on how best to utilize retained executive search firms. Shockingly, its corporate members have revealed that 40% of traditional retained executive searches fail to complete. Intellerati sees that as an opportunity. Research is the execution engine of executive search. It is how you uncover and ultimately deliver game-changing hires. By harnessing the power of investigative research, we can help fix what is broken about retained executive search. I founded Intellerati determined to do just that.

I witnessed what investigative research leveraging data could achieve in my previous career as an award-winning investigative journalist. My data analytics ah-hah moment came when I learned about the work of investigative reporter Bill Dedman in an investigation published by The Atlanta Journal and Constitution entitled “The Color of Money”. Mr. Dedman’s reporting was so ground-breaking, it received journalism’s highest honor, a Pulitzer Prize. The thing that amazed me then — and still blows my mind to this day — is that Dedman figured out a way to prove something that was impossible to prove before.

Lending Redlining and Racial Discrimination

Before that series, reporters could never prove that lending institutions in Atlanta were racially discriminating against prospective borrowers. Lenders would refuse to lend money or extend credit to borrowers in an illegal practice known as redlining as if they’d drawn a red line around areas more populated by racial minorities. People living inside the red-lined areas would be denied credit or charged exorbitant interest rates.

Before Dedman’s investigative series, all one could do was offer up anecdotal evidence, such as interviews with Black borrowers with excellent credit and high income, who were inexplicably denied a loan. To catch redlining lenders, consumer watchdogs would send in financially identical test couples to apply for a mortgage — one of the couples was white, the other was Black. Inevitably, the caucasian couple would emerge with a decent mortgage at an attractive rate, while the non-white couple would be denied a loan. However, whenever watchdogs confronted the lender with anecdotal evidence, the banks would insist they were equal opportunity lenders and that a rogue lending officer was to blame. Time and again, the lenders would wiggle out of accountability for discriminatory lending practices. That was until “The Color of Money”.

Ask Who Has the Data and Then Go Get It

The banks and savings and loans institutions were required to report the location of each loan they issued by census tract under the federal Home Mortgage Disclosure Act. So Bill used the federal Freedom of Information Act to obtain the lenders’ reports on computer tape from the Federal Financial Institutions Examination Council, a federal agency. He then matched the lending data with demographic data from the U.S. Census and with more current information from the Atlanta Regional Commission. By mashing the data sets together, he caught the redlining lenders red-handed. Bill proved that black people were rejected more than twice as often as white people when they applied for home loans at America’s savings and loans, according to government records of $1 trillion in loan applications analyzed by The Atlanta Journal-Constitution. Yep, that’s $1 trillion with a “t”.

The Power of Investigative Research

From where we sit, investigative research — real research — is not a name or a Google search term or a LinkedIn connection. It is not a job board or a tracking system or a database full of resumes. Rather, investigative research takes brain power, analyzing information, connecting the dots, and following where they lead. It requires some pretty advanced critical thinking to transform random bits of data into actionable intelligence. Most executive recruiters and candidate sourcers lack that level of investigative ability. That gives our innovative investigative approach a competitive advantage. It is how we deliver candidates that clients never dreamed existed — candidates other search firms miss.

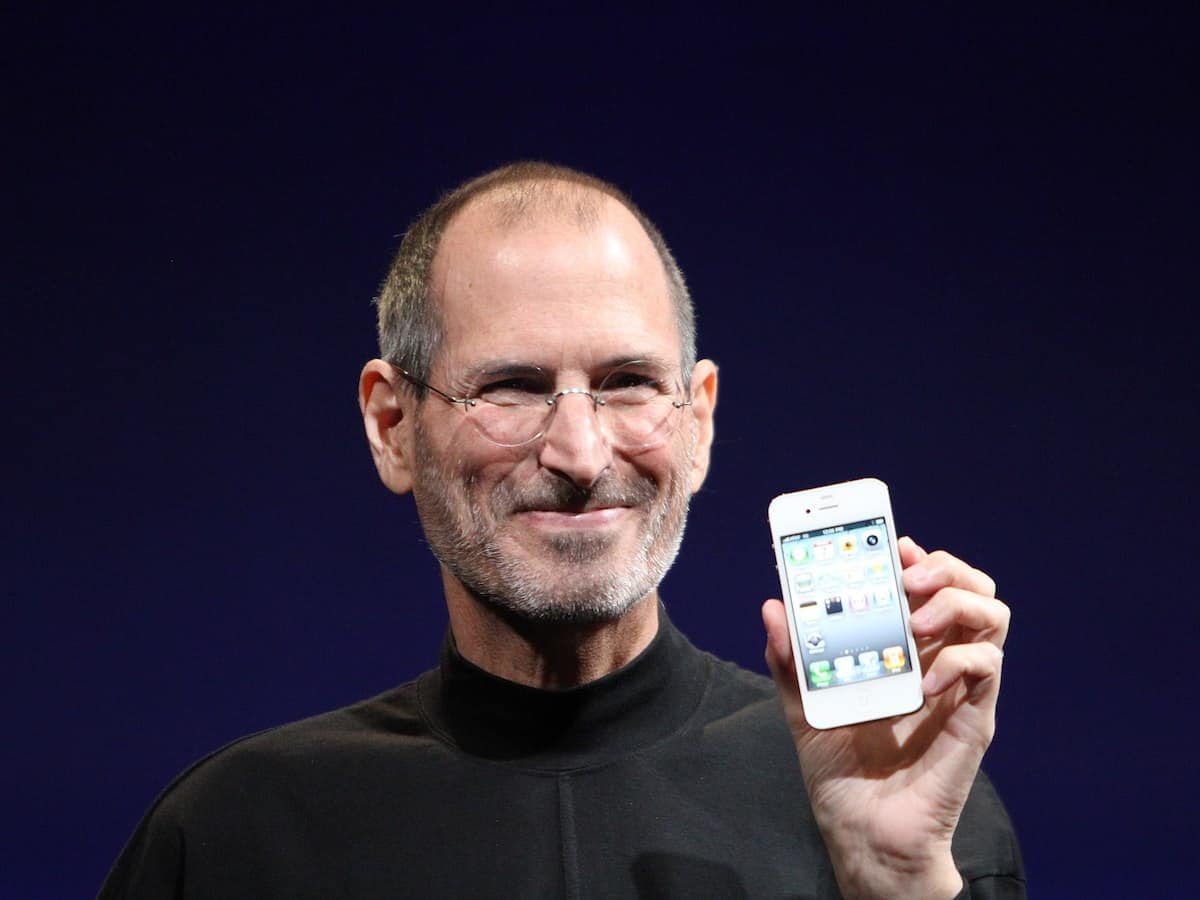

But human capital intelligence, informed by analytics, does so much more. One of the most powerful technology companies in the world used our investigative research for M&A and to cut 6 months from its time to market. The intelligence yielded millions of dollars in ROI.

The study of talent ecosystems wrapped around emergent technologies can inform the investments of private equity, venture capital, and corporate merger & acquisition teams. So, the next time your organization focuses obsessively on cost-per-hire to define your ROI and raison d’être, remember that investigative research that harnesses the power of data results in far more lucrative dividends.